Operation Profits

The profit from operations has declined from RM1.33 Million to RM1.15 million in 2016, which is a significant drop of 13.68% from the previous year. In FY2015 the operating profits decrease was 40.8% from prior year.

Profit Before Tax

The profit before taxation has been reduced significantly from RM0.41 million to RM0.30 million in 2016, which is a drop of 26.9%. In FY2015 the PBT was decreased from RM1.16 Million to RM0.41 i.e. a 65% from the prior year.

Profit After Tax

The Company posted a net profit after tax of RM155,430 as compared with RM 207,774 in 2016. The PAT decrease by 25.2% from the previous year. In FY2015 , the decrease was 75% from RM832,171 to RM207,774 .

Income Statement

(In Nearest RM’000)

Revenue

Gross Profit from Operations

Profit Before Tax

Taxation

Profit After Tax

Financial Result 2011 download

Financial Result 2012 download

Financial Result 2013 download

Financial Result 2014 download

Financial Result 2015 download

Financial Result 2016 download

Dividend Policy

The Company did not declare any dividend to the shareholders in FY2016. In FY2015 a final dividend of 2.5 cents per share was declared and paid to the shareholders.

Capital Gearing

The capital gearing is defined as the total company’s borrowing as a ratio to the shareholder’s fund as at Balance Sheet date. The total company’s borrowing was reduced to RM17.7 million in FY2016 from RM18.6 Million for FY2015 and FY2014. The capital gearing ratio has improved to 1.40 from 1.47 in FY2015.

Net Assets Value

The Company’s net asset value has increased from RM12.5 million to RM12.6 million. The net asset per share has not increased. The net asset value per share are indicated below:-

2016 2015 2014

Net Asset Value per share RM2.52 RM2.52 RM2.71

[ * Diluted net asset valuation in 2015 ]

Business Outlook

The economic slowdown will continue to dampen the net sales revenue in FY2017. The closure of the Beverages Division will have a negative impact on the sales revenue by RM8.8 million. The Company forecast a net sales revenue of approximately RM63.75 million. The operating divisions forecast their net sales revenue for 2017 as indicated below:-

( in RM Million ) FCT 2017 FY 2016

Dairy & Milk Powder 50.0 51.2

Disposable Soft Goods 12.3 11.6

Beverages * 1.5 10.3

---------------- ----------------

Total 63.8 73.1

__________ __________

The company will diversify into other business ventures to increase the net sales revenue for 2017-18. The Beverages division business comprised of Red Bull energy drink, Spritzer and Cactus Mineral Water , Ribena and Lucozade sports drinks ceased operation in April, 2017.

Unaudited Interim Results ( Period ended 31st May, 2017 )

( In RM Million ) YTD May 2017 YTD May 2016

Net Sales Revenue 27.452 31.552

Gross Profit and Other Income 2.963 3.235

Operating Overheads 2.922 3.092

Net Profit Before Tax 0.041 0.142

Taxation 0.028 0.042

Net Profit After Tax 0.013 0.100

------------------------------------------------------ END ---------------------------------------------------------------

For Clarification and further enquiries, Please contact

Mr Michael K V Chai

Executive Director Finance

DID : 603- 4295 9628

Email: munxin@gmail.com

2012

2013

2014

2015

79,423

80,673

82,490

76,131

1,859

2,049

2,248

1,330

1,071

1,023

1,158

405

(309)

(337)

(326)

(197)

762

686

832

208

155

(140)

296

1,148

73,111

2016

Financial Result

Check out the 2016 Financial Report

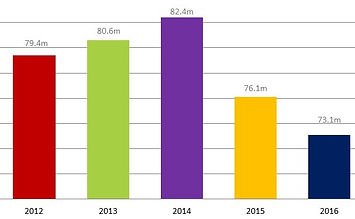

Our Company’s turnover has declined by 3.96% from RM76.1 million to RM73.1 million in 2016. This was mainly due to the slowdown experienced by the Fonterra Milk powder segment.

KEY FINANCIAL HIGHLIGHTS – 2016

Our Company’s turnover has declined by 3.96% from RM76.1 million to RM73.1 million in 2016. This was mainly due to the slowdown experienced by the Fonterra Milk powder segment.

73.1m

Business Performance

Dairy and Milk Powder Division ( Ambient )

The Fonterra Milk Powder division experienced a significant drop in turnover of RM10.48 Million i.e. from RM61.7 million to RM51.2 million during the year.

519K

The Fonterra Chilled Division posted a net operating income of RM519,603 during the year. The Fonterra Chilled Division is a merely a logistic and service provider. The net sales turnover is taken up in the accounts of Fonterra Brands (M) Sdn. Bhd.

Dairy Chilled and Frozen Products

11.57m

The Baby diapers division turnover experienced a slight increase in turnover to RM11.57 million from RM11.54 million.

Disposal Soft Goods Division

10.3m

The Beverages Division posted an increase in turnover to RM10.3 million from RM2.86 million. The Beverages Division commenced operation on 1st August, 2015. The FY2015 turnover represents a 5 months period was not a full year comparison. This segment of the business was closed in April, 2017 due to higher operation costs in warehousing and logistics operations.